0. Behavioral Models of Central Bank Digital Currency (CBDC) Adoption Intention: A Review

1. Introduction

Central Bank Digital Currency (CBDC) represents a pivotal innovation in the global financial ecosystem, defined as a digital form of a country's fiat currency, issued and managed by its central bank . This digital transformation aims to complement existing fiat money and enhance payment security, resilience, and efficiency . The growing relevance of CBDCs is underscored by the active exploration and preparation phases undertaken by central banks worldwide, such as the European Central Bank's initiatives for a digital euro .

The motivations behind central banks' exploration and implementation of CBDCs are multifaceted. Beyond improving payment systems, CBDCs are also considered for their potential implications for financial markets. A global survey by the CFA Institute, for instance, highlights the necessity of understanding the demand side of the CBDC debate, noting a limited global understanding and support for CBDCs among financial professionals, with significant regional and demographic variations in receptivity . This underscores the importance of public perception and adoption for the eventual impact of CBDCs on capital markets and investment practices . Furthermore, in developing nations, CBDCs are seen as a tool to address financial inclusion, particularly in countries where a significant portion of the population remains unbanked, such as India where over 20% of adults lack bank accounts . The success of CBDC adoption in these contexts is critically dependent on factors like public awareness, perceived benefits, trust in regulatory bodies, and concerns regarding its use . Other key features that may drive adoption include lower transaction costs, offline payment capabilities, enhanced privacy, and multiple accessibility features .

Despite the clear motivations for CBDC development, a common research problem identified across various studies is the limited understanding of public acceptance and user adoption intentions. Many papers emphasize the need for comprehensive insights into user behavior to ensure successful CBDC implementation . Authors consistently highlight the novelty of CBDC and the resultant gap in empirical understanding of the precise determinants affecting trialability, attitude, and behavioral intention. This research gap is particularly pronounced in specific market contexts, such as Indonesia's Digital Rupiah and India's digital rupee . The success of CBDCs hinges on understanding what drives user adoption of digital payment services, including user needs, design choices, and factors like usefulness, merchant acceptance, and network effects .

The purpose of this review is to systematically analyze and synthesize the behavioral models and key determinants influencing CBDC adoption intention. We will examine the various approaches adopted by researchers to investigate CBDC adoption intention. For instance, some studies employ multi-theoretical and multi-method approaches to understand individuals' attitudes and intentions towards CBDC adoption, as exemplified by research in Nigeria, a pioneering CBDC nation . Other research, such as the investigation into the Digital Yuan (e-CNY), focuses on specific influencing factors like trialability and the mediating effects of attitude, perceived trust, and self-efficacy on adoption intention . Furthermore, studies focusing on developing nations, like India, emphasize the role of public awareness, perceived benefits, and trust in regulatory bodies as crucial determinants for CBDC adoption, especially given concerns around financial inclusion . Research examining perceived risks and benefits further delves into how these factors impact trust and willingness to adopt, identifying that constructs like perceived usefulness significantly predict willingness, with trust partially mediating the impact of perceived risk . The varied approaches also include demographic-specific analyses, such as investigating Generation Z's behavioral intention to adopt CBDC in northern India using the Unified Theory of Acceptance and Use of Technology (UTAUT) to understand the roles of perceived trust, performance expectancy, and effort expectancy . This systematic synthesis will provide a comprehensive overview of the current state of research on behavioral models of CBDC adoption intention, highlighting commonalities, divergences, and areas for future inquiry.

2. CBDC Adoption Landscape and Context

Central Bank Digital Currencies (CBDCs) are defined as digital versions of fiat money issued by central banks, aiming to enhance payment security, resilience, and efficiency while minimizing issuance costs and boosting transaction convenience . They also serve to counteract the dominance of private payment systems . Globally, central banks are actively exploring or have launched CBDCs, with over 60 countries engaged in exploration and approximately 20 having fully launched their versions by 2023, including nations like the Bahamas, Jamaica, and Nigeria. India is in the early stages of CBDC introduction, and several European and Asian countries, such as Australia, China, and Indonesia, are in development phases .

The primary drivers for CBDC exploration and implementation by central banks largely center on public policy objectives, particularly its use as a means of payment . Key motivations include addressing financial inclusion challenges, especially in developing countries where a significant portion of the adult population remains unbanked. For instance, in India, over 20% of adults are unbanked, making financial inclusion a critical motivation for CBDC development . CBDCs are also pursued to enhance payment efficiency, ensure monetary policy effectiveness, and bolster financial stability by offering a safe and reliable digital payment instrument. The absence of continued innovation in payment systems could lead users to adopt less safe instruments, increasing economic and consumer harm, a risk CBDCs aim to mitigate by supporting innovation and competition . The rapid evolution of the digital payments landscape, characterized by increasing integration into digital services, further catalyzes the need for CBDCs that can support diverse, novel use cases and payment requirements .

From an economic perspective, CBDCs offer enhanced security, efficiency, and accessibility, alongside the potential to reduce cash circulation costs . Social benefits primarily revolve around financial inclusion, particularly in developing economies where CBDCs can bridge gaps in banking access . Technologically, CBDCs can facilitate programmability, offering flexibility and supporting innovation among intermediaries . However, there are significant perceived risks. Cybersecurity and fraud (69% of global respondents) and data privacy (64%) are chief concerns, followed by a perceived lack of clear use cases (40%) . Implementation challenges vary between developed and developing countries, encompassing technological, economic, social, political, environmental, and ethical issues . While 55% of respondents in a global survey believe CBDCs can coexist with private cryptocurrencies, there is an acknowledgment of a dichotomy where public trust in fiat money may be suffering due to quantitative easing and inflation, yet private money is still considered inferior to government money .

Demographic and cultural characteristics significantly influence CBDC adoption intention. Globally, younger respondents are more favorable towards CBDCs . This is exemplified by a study focusing on Generation Z digital payment users in northern India, which specifically investigates this demographic's adoption intentions . This particular focus highlights the importance of age-group specific analyses in understanding the adoption landscape. Income and education also play a role, although not explicitly detailed across all provided digests, the emphasis on financial inclusion in developing countries implicitly points to lower-income and less educated populations as key beneficiaries, suggesting that these factors influence the perceived utility and accessibility of CBDCs . A knowledge gap regarding CBDC, particularly among women, further suggests the influence of gender and educational disparities on awareness and adoption intent .

Cultural contexts play a pivotal role. The Nigerian market is highlighted as a pioneering nation in retail CBDC adoption, indicating the strong influence of local policies and societal readiness . Similarly, Indonesia's plan to issue a digital rupiah underscores its effort to align with global trends, focusing on retail CBDC adoption within its specific socio-economic framework . The empirical investigation of user perspectives on China's Digital Yuan (e-CNY) further demonstrates the impact of a specific national context on CBDC adoption, with e-CNY described as the digitized form of traditional currency issued by China's central bank and functioning as an electronic counterpart to cash . In contrast, the euro area context, particularly regarding the potential introduction of a digital euro, reflects a different landscape characterized by reduced cash usage and increasing non-cash payments, and the rise of FinTech. While awareness of the digital euro has increased, adoption propensity has not kept pace, suggesting the need for more effective communication strategies tailored to developed economies . This contrasts with emerging markets, where 61% of respondents are in favor of CBDCs compared to 37% in developed markets, attributed to differences in economic development and the potential for CBDCs to enhance financial inclusion in developing economies .

Central banks identify user needs primarily as the demand for a safe and efficient means of payment . They aim for CBDCs to support innovation and competition in payment systems to meet evolving demands . The success of CBDC adoption is therefore seen as contingent on fulfilling these unmet user needs, achieving network effects, and leveraging existing, accessible technology and infrastructure . However, user adoption intentions are not solely driven by these broad policy objectives. Factors such as public awareness, perceived benefits, and trust in regulatory bodies are critical for success, with concerns about cybersecurity, data privacy, and a lack of clear use cases often inhibiting adoption . While central banks focus on the design of a CBDC that might fulfill user needs, drawing lessons from past payment innovations, they acknowledge that strategies vary by jurisdiction and are not prescriptive about specific adoption levels . This indicates a divergence between the policy-driven objectives of central banks and the multifaceted factors influencing individual user adoption decisions, underscoring the importance of understanding the socio-economic and demographic contexts to bridge this gap.

3. Theoretical Frameworks for CBDC Adoption

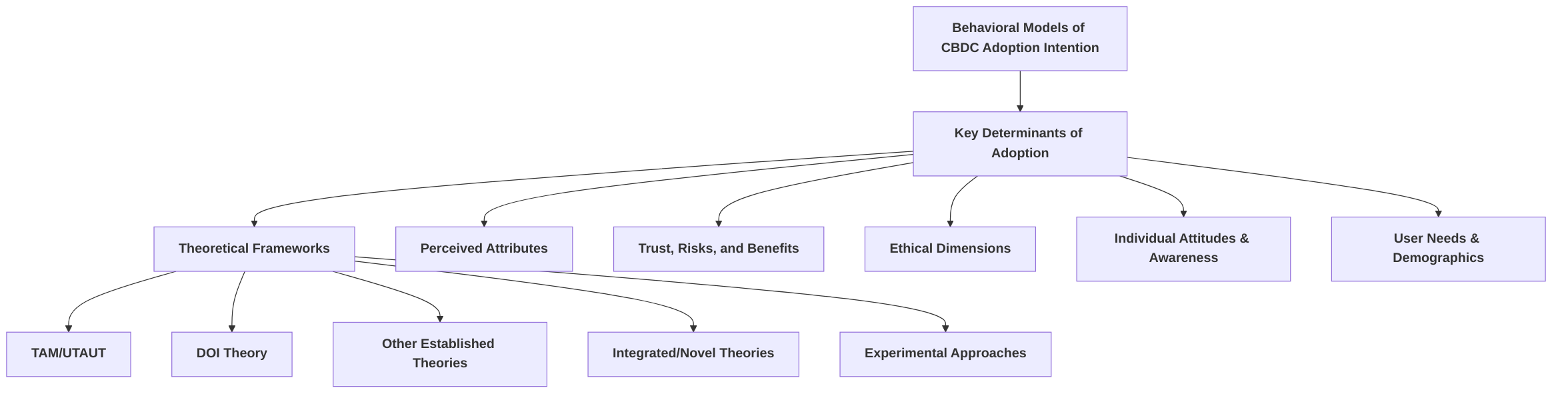

This section systematically reviews the theoretical frameworks employed to understand user intentions regarding Central Bank Digital Currency (CBDC) adoption, building upon the established context of socio-economic and demographic influences. We delve into prominent technology adoption theories, presenting their core constructs and relationships, and subsequently compare and contrast their utility in the unique context of digital currency adoption . The discussion will highlight which theories are most frequently applied, assess their strengths and weaknesses in capturing the nuances of CBDC adoption, and explore how these foundational theories can be adapted or extended to incorporate critical factors like central bank legitimacy, data privacy, and financial literacy.

The review is structured into five key subsections. The first subsection, "Technology Acceptance Models (TAM/UTAUT)," examines the pervasive application of TAM and UTAUT in CBDC research, detailing consistent findings regarding perceived usefulness and nuanced impacts of perceived ease of use, while also discussing the roles of social influence and demographic moderators. The second subsection, "Diffusion of Innovation (DOI) Theory," focuses on DOI's relevance, particularly the concept of trialability, and its interplay with compatibility, observability, and effort expectancy in influencing CBDC adoption, noting implicit applications in various studies . The third subsection, "Other Established Theoretical Frameworks," broadens the scope to include additional theories such as the Theory of Planned Behavior (TPB) and integrated models drawing from Social Cognitive Theory, Theory of Reasoned Action, and Valence Theory, with a particular emphasis on the critical role of trust in CBDC adoption .

Subsequently, "Integrated and Novel Theoretical Frameworks" specifically addresses advanced multi-theoretical models and novel approaches, including the application of Complexity Theory and fuzzy-set Qualitative Comparative Analysis (fsQCA), to identify necessary and sufficient conditions for CBDC adoption . This subsection highlights the strength of these frameworks in capturing the intricate interplay of diverse factors beyond individual utility. Finally, "Experimental and Causal Inference Approaches" critically evaluates methodologies like Randomized Controlled Trials (RCTs) used to establish causal relationships, contrasting them with correlational findings from observational studies and discussing their respective strengths and limitations in the CBDC context . This systematic decomposition and analysis will provide a comprehensive understanding of the theoretical landscape governing CBDC adoption research, identifying both robust insights and areas requiring further methodological and theoretical refinement.

3.1 Technology Acceptance Models (TAM/UTAUT)

Research on Central Bank Digital Currency (CBDC) adoption frequently leverages Technology Acceptance Models (TAM) and the Unified Theory of Acceptance and Use of Technology (UTAUT) to understand user intentions. These frameworks provide a structured approach to identifying key drivers of technology acceptance, although their application in the CBDC context reveals both consistent findings and notable discrepancies, particularly regarding perceived usefulness/performance expectancy and perceived ease of use/effort expectancy.

Perceived usefulness, or performance expectancy, consistently emerges as a significant predictor of adoption intention across various studies. For instance, in the context of Indonesian CBDC, perceived usefulness, defined as the extent to which a person believes using CBDC will improve their job performance, is hypothesized to directly influence intention to use CBDC . Similarly, studies related to the Digital Yuan (e-CNY) implicitly support the importance of utility through constructs like "price value," where users are more likely to adopt if they perceive the service as cost-effective, aligning with the concept that a valuable offering drives acceptance . While not explicitly using TAM/UTAUT, other research on CBDC adoption examines factors like financial inclusion benefits and ease of cross-border transactions, which directly contribute to the perceived usefulness of a CBDC, implying a broad agreement on the importance of functionality and benefits . This consistency underscores that potential users prioritize the practical advantages and enhancements CBDC offers over traditional payment systems.

In contrast, the impact of perceived ease of use or effort expectancy on CBDC adoption intention presents more nuanced and sometimes inconsistent findings. In the Indonesian context, perceived ease of use, defined as the belief that using a particular system will be easy, is hypothesized to influence the intention to use CBDC . However, research focusing on Generation Z's adoption of CBDC indicates a non-significant negative influence of effort expectancy on attitude, despite attitude positively influencing behavioral intention to use CBDC . This suggests that for this demographic, while ease of use might not directly shape their attitude towards CBDC, their overall positive attitude, possibly driven by other factors, still leads to higher adoption intention. This discrepancy could be attributed to different operationalizations of the construct or distinct characteristics of the sample populations. Generation Z, being digitally native, might have a higher baseline expectation for ease of use, rendering it less of a distinguishing factor in their adoption decisions compared to general populations. Another study, examining the e-CNY, found that effort expectancy, operationalized as the perceived effortlessness of using the e-CNY, positively influenced trialability, suggesting that ease of interaction is critical for initial engagement with the CBDC . However, facilitating conditions, which are closely related to ease of use by describing the availability of resources and support, did not show a significant positive effect on behavioral intention in that study, indicating a contextual variability in their impact . These variations underscore the importance of contextual factors, such as digital literacy levels, existing technological infrastructure, and the specific design of the CBDC itself, in shaping the influence of ease of use.

The roles of social influence and facilitating conditions are interpreted differently across cultural and economic contexts. Social influence, often defined as the perception that important others believe one should use the technology, is a key construct in UTAUT . In a study focusing on Generation Z's CBDC adoption, social influence is examined as a direct predictor of behavioral intention and also influences attitude, with perceived trust mediating these relationships . This highlights the significant role of peer recommendations and societal norms, which can be particularly pronounced in collectivist cultures or within specific demographic groups like Generation Z, who are heavily influenced by digital social networks. Similarly, indirect evidence from a study on Indian CBDC suggests the relevance of social influence through "usage by friends/families" as a factor aligning with TAM/UTAUT constructs, even without explicit framework adoption . Facilitating conditions, which refer to the degree to which an individual believes that organizational and technical infrastructure exists to support use of the system, did not consistently show a significant positive effect on behavioral intention in the context of Digital Yuan adoption . This non-significant finding might suggest that in certain contexts, where digital infrastructure is already robust or assumed, the mere existence of facilitating conditions may not be a primary driver of adoption intention, or other factors might overshadow its influence.

Demographic moderators, such as age, gender, education, and income, are critical in understanding the relationships within TAM/UTAUT. While specific details on how these moderators influence model relationships are not comprehensively detailed across all cited digests, the focus on Generation Z in one study provides insights into how a particular demographic's adoption factors might align or diverge from general populations . This research investigates perceived security, social influence, performance expectancy, effort expectancy, and attitude, and their influence on behavioral intention to use CBDC specifically within this age group . The finding that effort expectancy has a non-significant negative influence on attitude for Generation Z, while perceived usefulness (performance expectancy) likely remains important, hints at a divergence. Younger, digitally proficient generations may be less deterred by minor usability hurdles compared to older demographics, who might place a higher premium on ease of use. Conversely, factors like social influence and perceived security could be more pronounced for Generation Z due to their reliance on digital interactions and heightened awareness of online privacy and data protection. Future research should explicitly investigate and compare the moderating effects of various demographic factors to provide a more granular understanding of CBDC adoption across diverse user segments.

3.2 Diffusion of Innovation (DOI) Theory

The Diffusion of Innovation (DOI) theory provides a robust framework for understanding the adoption of new technologies, and its application to Central Bank Digital Currency (CBDC) is particularly pertinent given CBDC's status as a novel monetary technology. While many studies on CBDC adoption intent do not explicitly reference DOI theory, such as those by , the underlying constructs of DOI, such as perceived benefits (relative advantage) and ease of use (complexity), are often implicitly addressed.

A key attribute within DOI theory, "trialability," refers to the extent to which an innovation can be experimented with on a limited basis. In the context of CBDC, particularly the Digital Yuan (e-CNY), the concept of "trialability efficacy" has been empirically investigated . This concept is critical for new monetary technologies, as direct experience can significantly influence user attitudes and subsequent adoption intentions. The study by highlights that for e-CNY, trialability efficacy is not a standalone factor but is significantly influenced by other DOI attributes. Specifically, compatibility, observability, and effort expectancy were found to exert a positive influence on trialability.

Compatibility, defined as the alignment of e-CNY with users' existing values, needs, and past experiences, emerged as a significant determinant. This suggests that if a CBDC seamlessly integrates into a user's current financial practices and aligns with their understanding of money, they are more inclined to experiment with it. For instance, if a CBDC offers similar functionalities to existing digital payment systems but with added benefits like enhanced security or reduced transaction costs, its compatibility would be perceived as high.

Observability, which pertains to the degree to which the results of an innovation are visible to others, also positively impacts trialability. Observing successful adoption and positive outcomes by peers or early adopters can reduce perceived risks and increase the appeal of trying a CBDC . This social proof mechanism is particularly relevant for innovations like CBDC, where trust and network effects play a substantial role in widespread adoption. If individuals observe others successfully conducting transactions or experiencing benefits from CBDC use, their willingness to trial it is likely to increase.

Effort expectancy, or the perceived ease of use, likewise positively influences trialability. This aligns with broader technological acceptance models, where user-friendly interfaces and intuitive functionalities reduce the cognitive burden associated with adopting new systems. For a CBDC, this implies that the onboarding process, transaction execution, and overall user experience must be streamlined and simple to encourage initial experimentation . Complex procedures or a steep learning curve could deter potential users from even trialing the digital currency.

Interestingly, the study found that "relative advantage" did not significantly influence trialability in the context of e-CNY . Relative advantage refers to the degree to which an innovation is perceived as better than the idea it supersedes. While perceived benefits are often discussed in CBDC adoption literature (e.g., increased financial inclusion, reduced transaction costs, enhanced payment efficiency), the empirical finding suggests that for initial trialability, these perceived advantages might be less critical than the practical aspects of compatibility, observability, and ease of use. This contrasts with the traditional emphasis on relative advantage as a primary driver of innovation adoption in many contexts. It suggests that users might need to experience the benefits through trial before fully appreciating the relative advantage, or that the immediate, tangible benefits of CBDC are not yet clear enough to motivate trial solely on that basis.

Trialability itself was found to positively influence attitude towards e-CNY usage, indicating that a positive trial experience fosters a favorable disposition towards the CBDC. However, the study did not confirm a direct influence of trialability on behavioral intention . This suggests a potential gap or a more nuanced relationship where attitude mediates the effect on behavioral intention, or that other factors beyond trialability are necessary to translate positive attitudes into concrete adoption actions.

The inherent characteristics of CBDC present both alignments with and challenges to traditional DOI constructs. The emphasis on user experience, security, and integration with existing financial infrastructures (compatibility and effort expectancy) aligns well with DOI's focus on practical usability. However, the novel nature of a digital fiat currency, potentially replacing or coexisting with physical cash and commercial bank money, introduces unique complexities not fully captured by traditional DOI constructs. For example, issues of privacy, governmental control, and the absence of interest on CBDC holdings could introduce perceived risks that might not be adequately addressed within the standard DOI framework, particularly concerning their influence on trialability or broader adoption.

A significant gap in the application of DOI to CBDC adoption lies in the limited empirical research directly using DOI theory to investigate a broad spectrum of CBDC types and contexts beyond the e-CNY. While concepts like perceived benefits (often analogous to relative advantage) are commonly examined in studies not explicitly citing DOI, a systematic application of all DOI attributes (e.g., complexity, divisibility) across different CBDC designs (e.g., wholesale vs. retail, account-based vs. token-based) remains underexplored. Furthermore, the role of institutional trust and public awareness, critical for a monetary innovation, might require integrating DOI with other behavioral theories, such as the Technology Acceptance Model (TAM) or Trust-Based Adoption Models, to provide a more comprehensive understanding of CBDC adoption intention. The interdependencies between DOI attributes and external factors, such as government policies, economic stability, and public education campaigns, also warrant further investigation to fully grasp the dynamics of CBDC diffusion.

3.3 Other Established Theoretical Frameworks

While the Technology Acceptance Model (TAM) and Diffusion of Innovation (DOI) are prevalent in adoption research, a broader spectrum of theoretical frameworks has been applied to elucidate the behavioral dynamics of Central Bank Digital Currency (CBDC) adoption. These alternative approaches offer distinct strengths in capturing specific nuances often overlooked by TAM or DOI, yet they also present certain limitations.

One notable approach involves integrating multiple theories to construct a more comprehensive model. For instance, some research has moved beyond reliance on a single established framework like the Theory of Planned Behavior (TPB), instead combining Social Cognitive Theory, Theory of Reasoned Action, and Valence Theory to analyze individual attitudes and adoption intentions for CBDC . This integrative strategy allows researchers to account for a wider array of psychological and social factors influencing decision-making. Social Cognitive Theory, with its emphasis on self-efficacy and observational learning, can provide insights into how individuals' beliefs in their ability to use CBDC and their observations of others' usage influence adoption. The Theory of Reasoned Action, while simpler than TPB, still highlights the role of attitudes and subjective norms in shaping behavioral intentions. Valence Theory, by considering the perceived desirability of outcomes, adds another layer of complexity by examining the motivational aspects of adopting CBDC. The strength of such multi-theoretical models lies in their ability to provide a more holistic view of the adoption process, moving beyond the purely utilitarian focus of TAM (perceived usefulness and ease of use) or the innovation-centric view of DOI (relative advantage, compatibility, etc.). However, a potential weakness of combining multiple theories can be the increased complexity of the model, making it more challenging to empirically test and interpret, and potentially introducing collinearity among constructs if not carefully designed.

Another perspective implicitly draws upon elements similar to TPB without explicitly adopting it as the core framework. Studies examining constructs like awareness, trust, perceived benefits, expected problems, and adoption intent demonstrate this approach . While not explicitly named, the focus on awareness and perceived attributes aligns with general behavioral models that link perceived characteristics to adoption outcomes . The path analysis models used, such as Awareness Perceived Benefits Adoption Intent, and Trust Perceived Benefits Adoption Intent, suggest a construct-based approach that implicitly leverages the underlying principles of attitude-behavior theories. These models are particularly strong in emphasizing the foundational role of trust, which is a critical factor for financial instruments like CBDC but often less explicitly detailed in traditional TAM or DOI applications. The ability to incorporate specific concerns like "expected problems" offers a more granular understanding of potential deterrents to adoption, which may not be fully captured by generic perceived risk variables within TAM. The limitation, however, is that without explicitly anchoring to a well-established theory like TPB, the theoretical justification for the chosen constructs and their relationships might be less rigorous, potentially leading to ad hoc model development rather than leveraging established theoretical pathways.

The Theory of Planned Behavior (TPB) itself has been utilized as a supplementary framework in CBDC adoption research, particularly focusing on the role of attitude. For instance, studies on the digital yuan (e-CNY) have found that attitude significantly influences behavioral intention, consistent with TPB's core tenets . Furthermore, attitude has been shown to mediate the relationship between trialability and behavioral intention, reinforcing TPB's emphasis on attitudes as key drivers of behavior. TPB's strength lies in its ability to explain volitional behaviors by considering attitudes, subjective norms, and perceived behavioral control. Compared to TAM, TPB offers a more comprehensive framework by including social influences (subjective norms) and perceived ease or difficulty of performing the behavior (perceived behavioral control). For CBDC, where social acceptance and individual control over digital transactions are crucial, TPB provides a more nuanced lens. However, a potential weakness of TPB, especially when used as a supplementary framework, is that it might not fully capture the complexity of technological innovation characteristics that DOI emphasizes, such as relative advantage or compatibility, or the direct user-technology interaction aspects highlighted by TAM's perceived usefulness and ease of use.

Crucially, the concept of trust has emerged as a distinct and vital theoretical consideration in CBDC adoption studies. Beyond general behavioral models, some research integrates trust as a primary determinant, often differentiating between "hard trust" and "soft trust" . Hard trust pertains to the fundamental functions of money (unit of account, medium of exchange, store of value), while soft trust encompasses confidence in the system's security, privacy, and credibility. This granular approach to trust is a significant strength, as it directly addresses a core concern for any new monetary system. TAM and DOI, while acknowledging trust indirectly through constructs like perceived risk or compatibility, do not typically provide such a detailed decomposition of trust into its functional and systemic components. The explicit integration of trust highlights the unique nature of CBDC adoption, which is not merely about adopting a new technology but about adopting a new form of money, requiring inherent trust in its issuer and operational integrity. The weakness here, if trust is treated in isolation, is that it might underplay other critical behavioral factors like usability or social influence, which are well-addressed by TAM or TPB.

In comparative insights, different theoretical lenses offer unique perspectives on user adoption. TAM excels in explaining the initial acceptance of new technologies based on perceived benefits and ease of use. DOI is strong in describing the spread of innovations through a population, emphasizing innovation characteristics and adoption stages. TPB provides a robust framework for understanding the intention to perform a specific behavior by integrating attitudes, social pressures, and perceived control. However, for CBDC, the integration of multiple theories or the explicit focus on constructs like trust, awareness, perceived benefits, and expected problems offers a more tailored and comprehensive understanding. Theories that implicitly or explicitly incorporate trust are particularly valuable for CBDC, given its nature as a financial instrument and a public good. The breakdown of trust into "hard" and "soft" components provides actionable insights for policymakers aiming to foster adoption. Furthermore, models that combine elements from various theories, such as Social Cognitive Theory and Theory of Reasoned Action, can better capture the complex interplay of individual beliefs, social influences, and cognitive processes in a novel and impactful financial innovation.

In summary, while TAM and DOI offer foundational insights, their general applicability may not fully capture the specific behavioral dynamics of CBDC adoption. The explicit incorporation of trust, the consideration of expected problems alongside perceived benefits, and the integration of multiple theoretical perspectives (e.g., Social Cognitive Theory, Theory of Reasoned Action, Valence Theory) provide a richer and more nuanced understanding of user adoption intentions. These alternative frameworks, whether explicitly named or implicitly leveraged through construct-based models, underscore the multi-faceted nature of CBDC adoption, emphasizing the critical roles of confidence, social context, and a comprehensive assessment of risks and benefits in shaping public acceptance. Future research could further benefit from combining the strengths of these diverse frameworks to build even more robust predictive models for CBDC adoption.

3.4 Integrated and Novel Theoretical Frameworks

Traditional models of technology adoption, often rooted in single theoretical frameworks like the Technology Acceptance Model (TAM) or the Unified Theory of Acceptance and Use of Technology (UTAUT), provide foundational insights but may fall short in fully capturing the multifaceted nature of Central Bank Digital Currency (CBDC) adoption. The inherent complexity of CBDC, encompassing not only technological usability but also profound economic, psychological, and societal implications, necessitates a more comprehensive, multi-theoretical, or novel framework approach. Studies adopting such integrated stances offer a more nuanced understanding compared to those that do not explicitly integrate multiple theories or develop new models, such as .

A significant advantage of employing a multi-theoretical stance or developing novel frameworks is their capacity to address the intricate interplay of diverse factors influencing CBDC adoption. For instance, the study by uniquely integrates Social Cognitive Theory, Theory of Reasoned Action, and Valence Theory with Complexity Theory. This combination extends beyond typical technology adoption models by considering individual agency (Social Cognitive Theory), rational decision-making (Theory of Reasoned Action), the perceived value or appeal of CBDC (Valence Theory), and the emergent properties of a complex system (Complexity Theory). Such an approach moves beyond predicting intention based solely on perceived utility or ease of use, incorporating broader psychological and systemic influences. In contrast, models that focus on a more linear sequence of factors, such as the one by , which sequentially links awareness and trust to perceived benefits and then to adoption intent, while integrated, may not fully capture the simultaneous and reciprocal interactions of multiple theoretical constructs.

The benefits of these integrated approaches are further amplified when considering the economic and social dimensions of CBDC. For example, some integrated frameworks implicitly or explicitly touch upon economic incentives or theories of social conformity, even if not directly integrating established economic theories like Prospect Theory or Public Goods Theory. The inclusion of "societal positive valence of financial inclusion" as a necessary condition for high usage intentions in highlights a social dimension, where the perceived collective benefit influences individual adoption. This illustrates how psychological adoption models can be effectively broadened to include broader societal impacts that might drive adoption beyond individual utility. Similarly, the work by employs an innovative experimental design (RCTs) with information treatments and holding limits. While not explicitly integrating multiple theoretical frameworks in the same vein as some other papers, its methodological innovation in testing causal relationships and the impact of economic variables (holding limits) implicitly provides a more comprehensive understanding by bridging economic considerations with consumer attitudes and adoption intention. This represents a pragmatic integration of economic and psychological perspectives through experimental manipulation.

Furthermore, some studies introduce novel integrated models by extending existing frameworks. For instance, extends the Technology Acceptance Model (TAM) by incorporating "hard trust" and "soft trust" alongside personal innovativeness. This extension provides a richer understanding of trust, differentiating between institutional reliability (hard trust) and interpersonal or system-level confidence (soft trust), which are critical for financial innovations like CBDC. This contrasts with traditional TAM applications that might not sufficiently detail the nuances of trust specific to a central bank or a novel digital currency. Another example is the integration of constructs from Diffusion of Innovations (DOI) theory, UTAUT2, and the Theory of Planned Behavior (TPB) in . This comprehensive framework investigates direct and indirect relationships, including the mediating role of attitude between trialability and behavioral intention, and the moderating roles of perceived trust and self-efficacy. This multi-theory integration allows for a more granular analysis of how different psychological and technological factors interact to influence adoption, moving beyond the direct linear relationships often found in simpler models. The emphasis on trialability, a key DOI construct, combined with UTAUT2's hedonic motivation and price value, and TPB's perceived behavioral control, offers a robust framework for assessing CBDC adoption dynamics, particularly in the context of e-CNY.

A particularly insightful contribution from integrated approaches, especially those utilizing fuzzy-set qualitative comparative analysis (fsQCA), is the identification of necessary and sufficient conditions for adoption. The study by stands out in this regard. Employing fsQCA, it not only combines Social Cognitive Theory, Theory of Reasoned Action, and Valence Theory but also explicitly identifies four necessary conditions for high usage intentions: seamless transactions, trust in the central bank, a positive attitude, and the societal positive valence of financial inclusion. Necessary conditions, by definition, must be present for the outcome to occur. For instance, if 'trust in the central bank' is identified as a necessary condition, then the absence of trust will preclude high CBDC adoption, regardless of other factors. Mathematically, for a condition C to be necessary for an outcome O, it means , implying that O is a subset of C. This provides policymakers with critical insights into foundational requirements for successful CBDC implementation. Furthermore, the identification of six alternative configurations sufficient for high usage intentions through fsQCA underscores the equifinality of adoption pathways. This means that multiple combinations of factors, not just a single pathway, can lead to high adoption. For example, one sufficient configuration might be (seamless transactions AND positive attitude AND high financial inclusion) OR (trust in central bank AND perceived utility AND social influence). This methodological strength offers a far more detailed and actionable understanding of adoption dynamics than traditional regression-based analyses, which typically identify average effects and assume symmetric relationships, rather than specific combinations that are essential or sufficient.

In summary, integrated and novel theoretical frameworks offer a superior lens through which to understand CBDC adoption. They overcome the limitations of traditional, single-theory models by synthesizing insights from diverse psychological and sociological theories, often implicitly or explicitly incorporating economic considerations. The advantage lies in their ability to paint a more holistic picture, addressing the multifactorial complexity of CBDC. Methodologies like fsQCA, particularly when combined with multiple theories, further enhance this understanding by identifying necessary and sufficient conditions, thereby providing precise guidance for policymakers and researchers alike on the critical factors and combinations that drive or hinder CBDC adoption.

3.5 Experimental and Causal Inference Approaches

Experimental and causal inference approaches offer a robust methodology for establishing causal relationships in the context of CBDC adoption intention, contrasting sharply with the correlational findings typically derived from observational studies. The primary strength of these methods lies in their ability to manipulate specific variables and observe their isolated effects on outcomes, thereby providing higher internal validity. For instance, the study by exemplifies this by fielding multiple randomized controlled trials (RCTs) to investigate the causal impact of various factors on digital euro adoption.

One notable RCT within involved a Video Treatment, where respondents were randomly assigned to receive information about the digital euro via a video or not. This design directly aimed to establish the causal effect of communication on individuals' beliefs and their likelihood of adoption. By comparing the outcomes between the treatment and control groups, researchers could isolate the specific influence of informational videos, thereby contributing to a clearer understanding of adoption mechanisms. Another key experiment within the same study was the Holding Limits Experiment, where different holding limits (ranging from €1,000 to €120,000) were randomly assigned to participants. This allowed for the assessment of the causal impact of such limits on the propensity to adopt and the amount of funds allocated to digital euros. The study quantifies these causal impacts by reporting average marginal treatment effects (ATE) derived from probit and tobit models, providing concrete evidence of the specific causal pathways through which these factors influence adoption intention .

In contrast, many other studies on CBDC adoption rely on observational survey-based approaches, which, while valuable for identifying associations and building theoretical models, are inherently limited in establishing causality. For example, studies utilizing Partial Least Squares Structural Equation Modeling (PLS-SEM) and fuzzy-set Qualitative Comparative Analysis (fsQCA), such as , identify predictors and necessary/sufficient conditions for high usage intentions. While these methods can test hypothesized relationships between latent variables, they do not involve experimental setups or control groups in the traditional sense, meaning they infer relationships rather than directly demonstrating causality. Similarly, studies employing Exploratory Factor Analysis (EFA), Confirmatory Factor Analysis (CFA), and regression analysis on survey data, as seen in , primarily explore correlations and the influence of factors on adoption intent. These quantitative survey-based methods are effective for model validation and identifying relationships, but without experimental manipulation, it is challenging to definitively conclude causality. The use of Structural Equation Modeling (SEM) in , while allowing for the examination of hypothesized causal relationships between latent variables, also falls within the realm of observational studies, where causality is inferred based on theoretical models and statistical fit rather than direct experimental control.

The robustness of findings derived from experimental designs, particularly RCTs, is generally higher due to their ability to minimize confounding variables and biases. Random assignment ensures that, on average, the treatment and control groups are comparable in all aspects except for the intervention, making it highly probable that any observed differences in outcomes are attributable to the treatment itself. This provides a stronger basis for policy recommendations and interventions aimed at influencing CBDC adoption. For instance, if the video treatment consistently increases adoption likelihood, policymakers can confidently invest in similar communication strategies.

However, experimental designs, despite their strengths in establishing causality, possess inherent limitations in capturing the full complexity of real-world CBDC adoption. One significant limitation is the artificiality of laboratory or survey-based experimental settings. In a controlled experiment, participants' behaviors might not perfectly reflect their actions in a natural economic environment where numerous other unobserved factors and real-world constraints (e.g., trust in financial institutions, existing payment habits, peer influence, macroeconomic conditions) are at play. For example, the decision to adopt a CBDC is likely influenced by a dynamic interplay of economic incentives, perceived risks, trust in the central bank, and the prevailing socio-economic context, which are difficult to fully replicate and control in a limited experimental setup.

Furthermore, experimental designs often focus on a limited set of variables due to the practical challenges of manipulating many factors simultaneously. This can lead to an incomplete understanding of the multifaceted nature of adoption intention. While effectively isolates the effects of information and holding limits, other critical factors such as cybersecurity concerns, privacy perceptions, or the seamless integration of CBDC into daily transactions might not be directly manipulated or fully captured within the experimental framework. Observational studies, though weaker on causality, can sometimes capture a broader array of real-world variables and their complex interdependencies through large-scale surveys and econometric modeling.

In summary, experimental and causal inference approaches are invaluable for precisely identifying the causal impact of specific interventions on CBDC adoption intention, offering a level of scientific rigor that correlational studies cannot match. Their contribution lies in dissecting complex behavioral pathways and providing clear, actionable insights into how certain factors directly influence adoption. Nevertheless, their controlled nature and focus on specific variables mean they may not fully encapsulate the intricate, dynamic, and holistic decision-making processes inherent in real-world CBDC adoption. A comprehensive understanding therefore necessitates a combination of both experimental rigor and the broad contextual insights provided by robust observational studies.

3.6 Methodological Critiques and Comparative Effectiveness

Research into CBDC adoption intention has employed a diverse array of methodologies, each with distinct strengths and weaknesses that profoundly influence the nature and generalizability of their findings. A critical evaluation reveals how different analytical techniques, particularly in the context of specific theoretical models, shape the insights derived.

A notable distinction arises when comparing methodologies such as Structural Equation Modeling (SEM) and Fuzzy-set Qualitative Comparative Analysis (fsQCA). While SEM, particularly Partial Least Squares Structural Equation Modeling (PLS-SEM), is widely used for its ability to model complex relationships and identify direct predictors within theoretical frameworks like the Technology Acceptance Model (TAM), its application often assumes linear relationships and additive effects of variables. For instance, studies employing PLS-SEM to investigate factors influencing CBDC adoption in contexts like Indonesia focus on evaluating measurement models (indicator loading, composite reliability, AVE, HTMT) and structural models to establish causal links between perceived factors and adoption intention . This approach is effective in quantifying the strength and direction of these relationships, offering insights into which individual factors exert the most influence.

In contrast, fsQCA, often employed in conjunction with PLS-SEM in mixed-method approaches, offers a complementary perspective by identifying configurations of factors that jointly lead to an outcome, rather than focusing on the net effects of individual variables . This methodological synergy allows researchers to uncover complex, non-linear relationships and equifinality, where multiple different combinations of conditions can lead to the same outcome. While papers integrating PLS-SEM and fsQCA do not explicitly detail critiques of other methodologies, their choice of a multi-method approach is justified by the aim to provide deeper insights into complex adoption behaviors, moving beyond simple direct predictors to understand conjunctive causal relationships . This is particularly valuable for understanding nuanced behavioral intentions where the presence or absence of certain factors in combination, rather than in isolation, drives adoption.

The appropriateness and representativeness of chosen sample populations represent another critical methodological consideration, significantly impacting the generalizability of findings. Many studies rely on convenience or snowball sampling, which, while practical, often introduce selection bias and limit the ability to generalize findings to broader populations . For instance, a study on Digital Yuan adoption acknowledges that its findings are specific to Chinese users and recommends stratified or random sampling for future research to enhance generalizability to global banking sectors and CBDCs . Similarly, research focusing on Generation Z's adoption intentions highlights the need for broader demographic representation due to its specific age group focus and sampling limitations .

Geographical focus further compounds the issue of generalizability. Studies investigating intention to use CBDC in nascent markets like Indonesia, where CBDC has not yet been released, inherently face limitations in studying actual usage behavior . Such studies rely on hypothetical scenarios, which may not fully capture real-world adoption dynamics. Conversely, studies focusing on regions with active CBDC trials, such as the Digital Yuan, can provide empirical insights into user experiences, yet their findings are often context-specific and may not directly translate to other economic or regulatory environments .

Common limitations across many studies include reliance on self-reported data, which can be subject to social desirability bias, recall bias, or a lack of genuine understanding, especially concerning a relatively new concept like CBDC. For example, a study using a convenience sample revealed a significant knowledge gap among respondents regarding CBDC, particularly among women, and acknowledged that excluding and replacing unaware respondents could skew the sample . While measures like Cronbach's Alpha (e.g., 0.854) and KMO values (e.g., 0.887) indicate good reliability and sampling adequacy for analyzed factors, these metrics do not address underlying biases stemming from respondent awareness or convenience sampling .

Experimental designs, though less common, offer a robust alternative by addressing endogeneity issues inherent in observational studies. An experimental study investigating consumer attitudes towards CBDC, for instance, used treatment and control groups and robustness checks to mitigate survey demand effects and test for attention . This approach demonstrated that video communication is more effective than static mediums in changing beliefs and influencing immediate adoption likelihood, providing a stronger basis for causal inference . However, even experimental findings can have limitations, such as the observed fading of communication effects over time .

Furthermore, methodological critiques extend to the scope of analysis. Some reports, like those from the CFA Institute, offer broad global surveys of financial professionals, providing valuable insights into expert opinions and concerns such as the lack of clear use cases for CBDCs . While these surveys offer a broad perspective, their limitation lies in the self-reported nature of understanding and attitudes, which may not always align with actual behavioral intentions or needs. Similarly, non-empirical reports, while drawing lessons from past payment innovations and highlighting crucial design considerations like user needs, accessibility, and integration, do not offer explicit methodological critiques as they are not based on empirical data analysis .

In summary, the choice of methodology significantly impacts the validity and generalizability of findings in CBDC adoption research. While quantitative methods like PLS-SEM provide insights into direct causal links, mixed-methods incorporating fsQCA offer a deeper understanding of complex, configurational relationships. Sample selection remains a pervasive challenge, with convenience and snowball sampling limiting generalizability and potentially skewing results, particularly in studies focused on specific demographics or regions where CBDC is not yet fully implemented. Future research should prioritize more rigorous sampling strategies (e.g., stratified or random sampling) and consider experimental designs to overcome limitations associated with self-reported data and enhance the causal interpretability of findings. Mapping these methodological choices back to theoretical frameworks is crucial for understanding how different approaches either confirm or challenge the propositions of these models and their applicability across diverse contexts.

4. Key Factors Influencing CBDC Adoption Intention

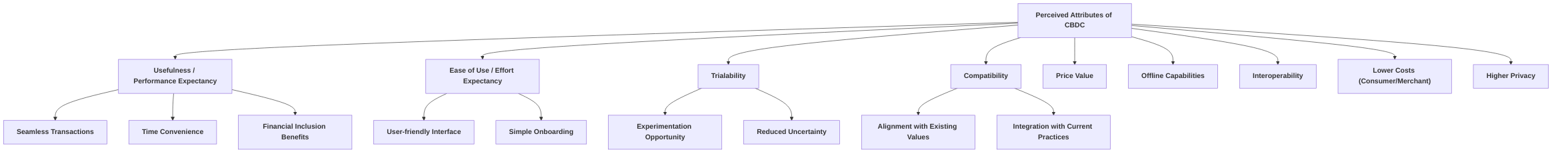

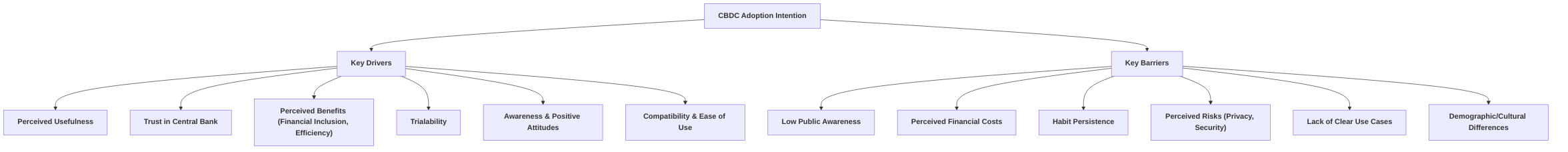

This section synthesizes the extant literature on key factors influencing Central Bank Digital Currency (CBDC) adoption intention, moving beyond individual study findings to identify overarching themes, divergent results, and their theoretical underpinnings. The factors are systematically categorized into "Perceived Attributes of CBDC," "Trust and Perceived Risks and Benefits," "Ethical Dimensions of CBDC Adoption," "Individual Attitudes and Awareness," and "User Needs and Demographic and Cultural Influences." Each subsection critically analyzes how these factors are conceptualized and measured within various theoretical frameworks, such as the Technology Acceptance Model (TAM), the Unified Theory of Acceptance and Use of Technology (UTAUT), and Diffusion of Innovations (DOI) theory, contrasting correlational findings with reported necessary and sufficient conditions for adoption.

The "Perceived Attributes of CBDC" subsection will delve into how characteristics inherent to CBDC design, such as usefulness, ease of use, trialability, and compatibility, influence adoption intention. It will explore consistent findings across studies, such as the pervasive importance of perceived usefulness and ease of use, while also highlighting discrepancies, like the varied impact of relative advantage . This analysis will draw comparisons between how these attributes are conceptualized in TAM (e.g., perceived usefulness) versus DOI (e.g., relative advantage), and how their measurement captures user perceptions of efficiency, simplicity, and alignment with existing values.

The "Trust and Perceived Risks and Benefits" subsection will examine the critical interplay between user trust, the perceived advantages, and the potential drawbacks of CBDCs. It will highlight common benefits, such as financial inclusion and payment efficiency, alongside significant risks like cybersecurity, fraud, and privacy concerns . This section will further analyze the mediating or moderating role of trust in the relationship between perceived risks/benefits and adoption intention, contrasting studies that empirically test these relationships with those that implicitly assume them .

"Ethical Dimensions of CBDC Adoption" will focus on the often-implicit, yet critical, concerns related to privacy, surveillance, and government control. It will discuss how these ethical considerations shape user trust and impact adoption, even when not explicitly integrated into traditional behavioral models . This section will argue for the necessity of expanding existing theoretical frameworks to formally incorporate constructs such as "Perceived Privacy Risk" to provide a more comprehensive understanding of user resistance or acceptance.

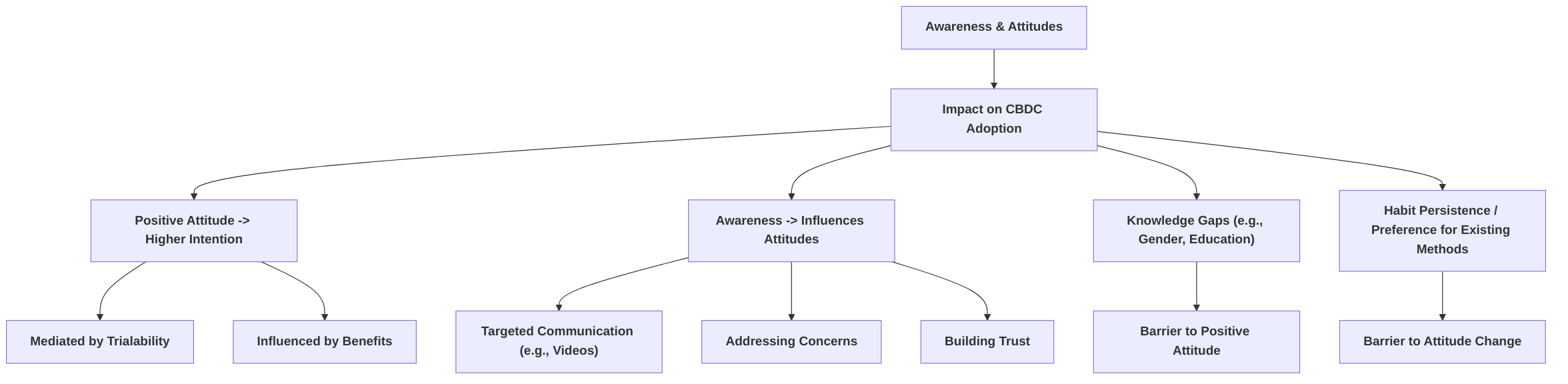

The "Individual Attitudes and Awareness" subsection will explore the direct and indirect roles of individual attitudes and awareness in shaping CBDC adoption. It will discuss how awareness influences attitudes, which in turn significantly predict behavioral intention, emphasizing that effective communication must not only inform but also cultivate positive attitudes by addressing concerns and building trust . The section will also consider the influence of factors like habit persistence and personal innovativeness on attitudes.

Finally, "User Needs and Demographic and Cultural Influences" will underscore the importance of tailoring CBDC designs and adoption strategies to diverse user profiles. It will highlight how demographic factors such as age and gender, and cultural nuances like economic development levels, significantly modulate perceived benefits, risks, and trust, ultimately affecting adoption intentions . This subsection will integrate sociological and psychological perspectives to demonstrate how collective values and individual biases interact with theoretical constructs, emphasizing the need for a context-sensitive approach to CBDC implementation.

4.1 Perceived Attributes of CBDC

The perceived attributes of Central Bank Digital Currency (CBDC) significantly influence adoption intention, with various studies highlighting both consistent and disparate findings across different contexts. A critical attribute, trialability, has been empirically investigated for its efficacy in promoting CBDC adoption, particularly in the context of the Digital Yuan . This research found that compatibility (), observability (), and effort expectancy () positively and significantly influence trialability. Furthermore, price value significantly and positively affects behavioral intention () . This suggests that the ability for users to experiment with CBDC, observe its benefits, and find it easy to use, is crucial for fostering initial engagement and subsequent adoption. Conversely, relative advantage did not exhibit a significant positive influence on trialability in this study, indicating that merely presenting CBDC as superior to existing alternatives may not be sufficient without the practical experience of trialability .

The concept of trialability is particularly relevant for novel financial technologies like CBDC, which introduce a new paradigm in digital payments. Unlike established digital payment systems, CBDC lacks a pre-existing user base and established behavioral patterns. Therefore, providing opportunities for users to experiment with the technology in a low-risk environment can mitigate perceived uncertainties and build confidence. This hands-on experience allows potential adopters to personally verify the promised benefits, such as seamless transactions and time convenience, which are identified as key affordance-based positive valences driving positive attitudes and usage intentions towards CBDC .

Several perceived attributes consistently emerge as significant predictors of CBDC adoption. Perceived usefulness and perceived ease of use are frequently cited as pivotal in behavioral models such as the Technology Acceptance Model (TAM) and the Unified Theory of Acceptance and Use of Technology (UTAUT). Studies consistently confirm that greater perceived usefulness and ease of use lead to a higher intention to use CBDC . For instance, "seamless transactions" and "time convenience" directly relate to the perceived usefulness and ease of use of CBDC, serving as strong predictors of positive attitudes and usage intentions . Similarly, the importance of "performance expectancy" (the degree to which using the system will help achieve gains) and "effort expectancy" (the degree of ease associated with system use) are emphasized, aligning with the core tenets of perceived usefulness and ease of use . These attributes are often operationalized through survey instruments that ask users to rate statements regarding the efficiency, effectiveness, and simplicity of using CBDC.

Beyond these well-established attributes, other features are consistently identified as crucial. Offline capabilities and interoperability receive strong global support, underscoring the user demand for accessibility under various technical conditions and seamless integration with existing payment systems . The ability to make payments without an internet connection, mirroring the attributes of physical cash, is a significant draw, as highlighted by experimental designs that emphasize such practical features . Lower costs for consumers and merchants, higher privacy compared to commercial options, and multiple accessibility features are also proposed as valuable characteristics that could drive adoption . The perceived safety and security of CBDC, particularly compared to other digital transactions, are implicitly recognized as key attributes influencing adoption intention, despite not always being explicitly categorized within standard behavioral models . These perceived benefits, such as improved financial inclusion in rural areas, reduced dependency on physical cash, and easier cross-border transactions, reflect the broader utility and societal impact of CBDC .

However, some perceived attributes demonstrate varied results, often depending on the specific CBDC design or cultural context. For instance, while the desire for CBDCs to pay interest is notable, particularly in emerging markets, indicating a perceived financial benefit , this aspiration often contrasts with central bank inclinations to maintain financial stability and avoid disintermediation. Furthermore, studies on the digital rupee have shown that perceived usefulness did not significantly predict the willingness to adopt, and perceived ease of use did not significantly impact trust for adoption . These discrepancies might stem from the specific design of the digital rupee, including its features or target user base, or reflect unique cultural attitudes towards digital payments and financial innovations in that region. For instance, if a CBDC's design does not clearly articulate a functional advantage over existing payment methods, its perceived usefulness might not translate into adoption intent. Similarly, if there are underlying trust issues, ease of use alone may not suffice to build confidence.

These perceived attributes are theorized and operationalized within various behavioral models discussed in Chapter 3. The Technology Acceptance Model (TAM) and its extensions, such as UTAUT, are fundamental in operationalizing perceived usefulness and perceived ease of use, often through multi-item scales measuring user beliefs about the effectiveness and simplicity of using the technology. The Diffusion of Innovations (DOI) theory provides a framework for understanding attributes like relative advantage, compatibility, trialability, observability, and complexity, each measured by assessing user perceptions of these characteristics. For instance, compatibility is operationalized by measuring how well CBDC aligns with existing values, experiences, and needs, while observability assesses the visibility of its results to others. Furthermore, constructs from the Expectancy-Value Theory, such as performance expectancy and effort expectancy, are often integrated into UTAUT-based models to capture the anticipated benefits and ease of use of CBDC. The varying significance of attributes across studies underscores the importance of contextual factors, including the specific design features of a CBDC, the socio-economic characteristics of the target population, and existing payment infrastructure, all of which influence how these attributes are perceived and, consequently, their impact on adoption intention.

4.2 Trust and Perceived Risks and Benefits

The adoption intention of Central Bank Digital Currencies (CBDCs) is significantly influenced by user perceptions of trust, risks, and benefits. Various studies highlight distinct types of risks and benefits, demonstrating their interplay in shaping trust and, consequently, adoption intention.

Regarding perceived benefits, common themes include improved financial inclusion, reduced dependency on cash, and enhanced efficiency in cross-border transactions . The ability to accelerate payments and transfers is a significant driver, with 58% of respondents in one survey citing this as a reason for supporting CBDC issuance . Additionally, the inherent safety of central bank money and the potential for increased privacy compared to commercial options are seen as foundational elements that could foster trust and encourage adoption . Success in past payment innovations often hinged on benefits outweighing costs, indicating that the perceived advantages of a CBDC must be substantial enough to overcome any associated user costs or inertia .

Conversely, perceived risks present significant barriers to CBDC adoption. Primary concerns across studies include cybersecurity and fraud (69%) and data privacy (64%) . Other notable risks encompass difficulties for non-tech-savvy individuals, challenges with rural internet access, potential hidden fees, and concerns about increased government control over personal finances . Financial cost is also identified as a significant barrier .

The interplay between perceived risks and benefits, and their joint influence on trust and adoption intention, is a critical area of investigation. Studies indicate potential trade-offs, such as the balance between convenience and privacy. While a CBDC might offer greater convenience through accelerated payments, concerns about government oversight and data privacy can create apprehension, reflecting a trade-off between perceived benefit (convenience) and perceived risk (loss of privacy) . The emphasis on specific risks or benefits can vary depending on the target demographic or CBDC context. For instance, studies focusing on general populations tend to highlight broad concerns like cybersecurity and privacy, whereas a study specifically examining Generation Z might implicitly focus on perceived security as a key factor influencing trust and adoption, potentially due to this demographic's familiarity with digital platforms and heightened awareness of data breaches .

Trust plays a critical mediating or moderating role in CBDC adoption. Several studies underscore its importance as a necessary condition for high usage intentions . Different dimensions of trust have been investigated. One study distinguishes between "hard trust," pertaining to the fundamental functions of money, and "soft trust," related to system security and credibility. Both hard and soft trust are found to have a positive and significant effect on the intention to use CBDC, emphasizing that building comprehensive trust is crucial for acceptance . Another perspective explores trust in the central bank (e.g., RBI) to effectively manage the CBDC, finding it directly influences adoption intention and also influences perceived benefits, which in turn affect adoption intent .

The relationship between perceived risks/benefits and trust is often empirically tested. For example, some research demonstrates that perceived risks can have a partial mediation effect on willingness to adopt, with trust playing a pivotal role in this mediation; specifically, perceived risks impact trust, which subsequently impacts willingness to adopt . This contrasts with studies that implicitly mention risks as reasons for non-adoption without empirically testing their direct relationship with trust. For instance, a preference for existing payment methods, which can be interpreted as a lack of perceived benefit or an underlying distrust, indirectly suggests the impact of unaddressed risks on adoption . Explicit empirical testing, such as in the study finding trust mediates the impact of perceived risk on willingness to adopt, provides stronger evidence for these relationships . Similarly, perceived security is often linked to perceived risks, with perceived trust mediating its influence on attitude towards CBDC adoption .

The theoretical grounding of these factors often aligns with established behavioral models. For instance, the mediation of trust between perceived risks/benefits and adoption intention resonates with models like the Technology Acceptance Model (TAM) or Theory of Planned Behavior (TPB), where attitudes (influenced by perceived benefits and risks) and subjective norms (influenced by social influence and trust) drive behavioral intentions. Trust, particularly in the central bank, can be viewed as a crucial external variable or a direct antecedent to perceived usefulness and ease of use within the TAM framework, as it directly impacts users' confidence in the CBDC's functionality and security. The "soft trust" dimension, encompassing system security and credibility, directly maps to the perceived security component often integrated into extended TAM models. Furthermore, the notion that trust in the central bank can mitigate concerns about risks like government control over finances highlights trust's role as a critical determinant in shaping user perceptions and facilitating adoption, as theorized in models that consider institutional trust as a key enabler of new technology adoption . The emphasis on building trust for CBDC acceptance aligns with the overarching principle that user confidence is paramount for the successful diffusion of innovations.

4.3 Ethical Dimensions of CBDC Adoption

Ethical considerations, particularly those concerning privacy and surveillance, represent a critical, yet often underexplored, dimension influencing user trust in Central Bank Digital Currencies (CBDCs) and, consequently, their adoption intentions. While some studies on CBDC adoption prioritize behavioral and economic factors, often omitting explicit discussions of ethical dimensions , the extant literature suggests that these ethical concerns are implicitly, if not explicitly, central to public perception and willingness to embrace a new digital currency.

A significant ethical concern revolves around the potential for increased government control over personal finances and the associated implications for individual privacy . This perceived problem directly impacts user trust, which is a necessary condition for high usage intentions . The tension between privacy and financial oversight is a recurrent theme. For instance, data privacy ranks as a paramount concern among respondents in global surveys, with 64% identifying it as a top issue . This highlights a critical dilemma for central banks: balancing the need to combat illicit activities, such as money laundering and terrorism financing, with the imperative to safeguard individual privacy. Achieving this equilibrium necessitates meticulous design features and transparent communication strategies to foster public trust .

The concept of privacy in CBDCs is multifaceted. While some studies highlight "a higher level of privacy in comparison to commercial options" as a potentially valuable feature , other research indicates consumer apprehension regarding the anonymity and privacy of a digital euro, particularly when compared to existing non-cash payment methods . Concerns about surveillance and the government's access to personal payment data are potent drivers of reluctance. The Eurosystem, for example, has publicly stated its disinterest in personal payment data and emphasizes that offline payment options within a CBDC framework could offer enhanced privacy . This suggests that the design choices made by central banks, particularly regarding the degree of anonymity or pseudonymity offered, directly influence the ethical perception of CBDCs.

The trade-offs between government control and individual privacy are inherent in CBDC design. A CBDC could potentially offer a granular level of financial data that is currently inaccessible to authorities, raising legitimate fears of financial surveillance. Conversely, proponents argue that a well-designed CBDC could enhance privacy compared to existing commercial digital payment systems, where private entities often collect and monetize vast amounts of user data . The debate often boils down to trust: trust in the central bank to uphold privacy principles and to use financial data responsibly .

These ethical considerations significantly impact the applicability and explanatory power of theoretical models of adoption, as discussed in Chapter 3. Traditional technology adoption models, such as the Technology Acceptance Model (TAM) or the Unified Theory of Acceptance and Use of Technology (UTAUT), primarily focus on perceived usefulness and perceived ease of use. While "trust" is often incorporated as an external variable or a mediating factor, the explicit ethical dimensions of privacy and surveillance are not always deeply integrated. For instance, the perception that "CBDC may increase government control over personal finances" could be conceptualized as a perceived risk, negatively impacting perceived usefulness or fostering resistance . Conversely, the notion that "CBDC would help to maintain privacy and security" could contribute positively to perceived usefulness and trust .

However, these models may need to be expanded to explicitly account for ethical calculus. For example, a "Perceived Privacy Risk" construct could be introduced, directly moderating the relationship between trust and adoption intention. Similarly, "Government Surveillance Concern" could act as a direct predictor of resistance to adoption, irrespective of perceived utility. The inclusion of such constructs would allow for a more nuanced understanding of how deep-seated ethical values and anxieties shape individual decisions regarding CBDC adoption. Without explicitly addressing these ethical dimensions, theoretical models may offer an incomplete picture of adoption intentions, particularly in contexts where public discourse around digital currencies is heavily influenced by privacy debates. Future research should aim to integrate these ethical constructs formally into existing or novel behavioral models to provide a more comprehensive and accurate framework for predicting CBDC adoption.

4.4 Individual Attitudes and Awareness

Consumer attitudes represent a pivotal determinant in shaping the adoption intentions of Central Bank Digital Currencies (CBDC). Research consistently identifies a positive attitude towards CBDC as a significant predictor of usage intentions, even positing it as a necessary condition for high adoption rates . This relationship is further elucidated by studies demonstrating that favorable experiences, such as trialability, can directly foster positive attitudes, which subsequently drive behavioral intention. For instance, in the context of the digital yuan, attitude was found to be positively influenced by trialability () and to significantly influence behavioral intention (), illustrating a direct mediatory role of attitude between trial experiences and adoption outcomes .

The causal pathways between awareness, attitudes, and adoption intention are multifaceted. While an increase in awareness about CBDC has been observed over time, particularly for initiatives like the digital euro, this heightened awareness does not automatically translate into a higher propensity to adopt . This divergence suggests that mere informational dissemination, without influencing underlying attitudes, may not be sufficient for driving adoption. Instead, effective information provision, such as through targeted educational videos, has been shown to induce a positive causal effect on consumer beliefs and encourage adoption . This implies that awareness campaigns and educational initiatives are most impactful when they are designed to shape positive attitudes by highlighting benefits and addressing concerns, rather than simply informing.

Trust plays a critical role in shaping CBDC adoption intentions, often mediated through awareness and perceptions of risk. Awareness itself is a crucial determinant, with significant knowledge gaps identified, particularly among specific demographics such as women . Studies exploring awareness levels, for example concerning the Digital Rupee and its distinction from existing payment systems like UPI, demonstrate that awareness positively influences both perceived benefits and trust . This suggests a pathway where increased awareness builds trust, which in turn fosters positive attitudes by enhancing the perception of benefits and mitigating perceived risks. Conversely, a lack of understanding regarding CBDCs is widespread even among financially literate professionals, with a significant proportion remaining undecided on central bank issuance, highlighting a substantial opportunity for targeted education and outreach to influence attitudes and, subsequently, adoption .